Stock futures fell early Tuesday after Wall Street ended a tumultuous month with heavy losses as investors grappled with the Federal Reserve's change in policy.

Dow Jones Industrial Average futures fell 71 points. down 0.28%.

While stocks staged a tech-driven rally on Monday, the major averages were still suffering from a brutal month of wild price swings.

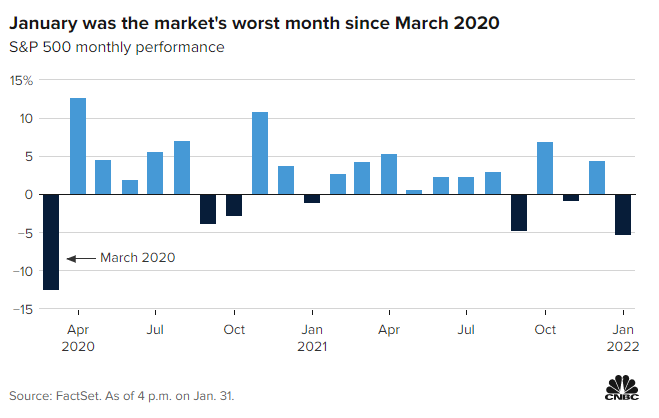

The SandP 500 and Nasdaq Composite posted their worst months since March 2020 in the depths of the pandemic, down 5.3% and 8.9%, respectively.

It was also the SandP 500's biggest January drop since 2009 the blue-chip Dow fell 3.3% for the month.

January's sell-off came as the central bank signaled its readiness to tighten monetary policy, including raising interest rates multiple times this year, to stem inflation, which has risen to the highest level in almost four decades.

Investors exited growth-oriented technology stocks, which are particularly sensitive to rising interest rates.

Volatility exploded over the month as investors deciphered the Fed's messages about its policy pivot. briefly fell 10% from its all-time high.

The recent rally pushed the 6.3 large cap benchmark to its bottom. Meanwhile, the tech-heavy Nasdaq is still in a correction, down 12% from its all-time high. Still, many Wall Street strategists are reminding investors that bull market corrections are normal.

Since 1950, there have been 33 SANDP 500 corrections of 10% or more since 1950, and the average episode lasted about five months to Goldman Sachs.

"The last decline is a normal correction of the market that does not display a recession or the.